Unlocking Alpha: Harnessing the Power of Supply Chain Insights

Discover Competitive Advantages by Analyzing Global Supply Chain Trends and Uncovering Hidden Opportunities

Often, retail investors exhibit a home country bias, primarily focusing on their domestic stock market due to familiarity, language barriers, or a lack of awareness of potential advantages in exploring foreign markets. In contrast, institutional investors possess the resources to allocate analysts to investigate suppliers in different countries and gain insights into market trends.

Seasoned investors may be hesitant to delve into foreign stock markets because they perceive a lack of advantage in those markets. Particularly when not physically present, understanding the local landscape can be challenging when examining businesses such as supermarkets and retailers.

However, the global economy is now highly interconnected. It is uncommon for everyday products not to be manufactured, assembled, and shipped from various countries. Investigating suppliers can offer several advantages:

More frequent public financial information disclosure: For instance, Taiwanese publicly listed companies report monthly revenue, while companies in the United States do not. This allows for more timely analysis of financial performance.

Differing financial year schedules: In Japan, the fiscal year typically begins in March, with companies making half-year earnings forecasts in March and September. In Taiwan, earnings calls usually occur in May and June. Monitoring competitors in Japan can provide insights into Taiwanese companies' performance with a one or two-month lead time.

The Bullwhip Effect: In cyclical industries like semiconductors, analyzing the revenue growth rates of upstream and downstream companies can reveal that downstream companies often peak and trough before their upstream counterparts. This time gap can be exploited by observing the revenue recovery of downstream companies and subsequently investing in upstream companies, anticipating a stock rebound.

Exploring foreign markets does not necessarily entail purchasing stocks from those markets. Identifying upstream and downstream relationships between companies in local and foreign markets can be a valuable investment of time, providing an information edge that benefits your domestic portfolio. Additionally, advances in machine learning have significantly reduced language barriers. Services like ChatGPT can translate or summarize information, enabling investors to access and understand foreign market insights more easily.

Examples

Here are a few examples of how leveraging supplier information can be advantageous for stock trading decisions:

A 14-day early warning before a stock's 25% drop due to halted production:

On January 20th, Peloton announced a pause in the production of its bikes and treadmills as a result of waning demand. The stock plummeted by 25% that day. However, as early as January 6th, there was news that Rexon, the primary supplier of Peloton's bikes in Taiwan, had planned to lay off 400 workers. In cases where business downturns are temporary, suppliers are generally hesitant to lay off skilled workers, as rehiring them quickly once business resumes can be challenging. A significant layoff at the supplier level signals a substantial red flag concerning future demand and serves as an ominous sign for the buyer – in this case, Peloton. By being aware of this news, investors would have had a nine-trading-day head start to take action.

傳無預警大裁員 力山:因應淡旺季人力調整 | Anue鉅亨 - 台股新聞 (cnyes.com)

Peloton to pause production of its Bikes, treadmills as demand wanes (cnbc.com)

DRAM module suppliers' revenue growth precedes that of DRAM chip suppliers:

When comparing the year-over-year (YoY) revenue growth rates of ADATA and Micron on a graph, it becomes evident that the blue line (ADATA) leads the black line (Micron). This pattern is economically logical. As consumer demand declines, DRAM module companies' revenues are impacted first, leading them to reduce chip purchases from upstream suppliers like Samsung, Hynix, or Micron. Consequently, the upstream suppliers' revenues decrease in subsequent quarters. During an economic upturn, DRAM module companies experience recovery first, selling off their existing inventories before restocking by purchasing chips from manufacturers once again.

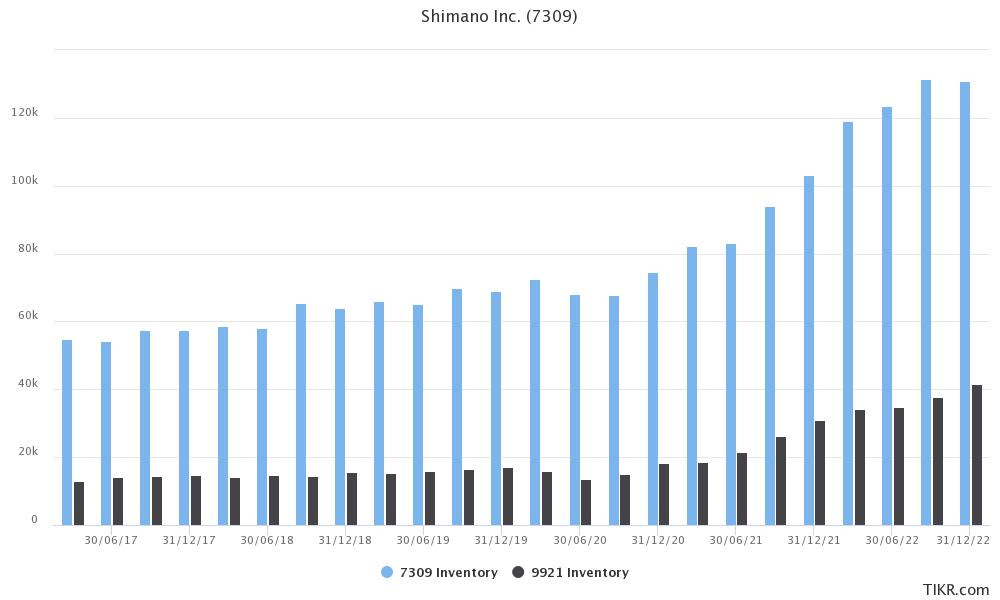

Japanese cycling component companies announced filings one month before the Taiwanese cycle manufacturer:

On December 12, 2022, Giant announced a 45-day extension to its supplier payment terms, causing market concerns and leading to a 10% drop in the stock price the following day. However, a month earlier on November 11, 2022, Shimano, a prominent cycling component manufacturer, had already reported inventory backlog issues. Investors who reviewed Shimano's earnings call would not have been surprised by Giant's subsequent inventory issue and would have known to monitor the stock price until the inventory concerns were resolved.

These inventory issues can be extrapolated to the entire bike gear industry. Products like helmets and necklaces are not disposable and require periodic replacement. It is difficult to imagine that, while encountering inventory challenges with bicycles, helmets would not face similar headwinds. Poor financial quarters for Giant and Merida serve as red flags for the performance of popular microcap bike gear brands like LEATT, whose stock dropped from 18 to 10 on March 28, 2023.

自行車庫存積壓 巨大驚爆現金流吃緊 公司回應了 | Anue鉅亨 - 台股新聞 (cnyes.com)

Summary of Financial Results FY2022-Q3.pdf (shimano.com)

In Conclusion

The examples above demonstrate the potential advantages of closely monitoring supply chain news. By setting up Google Alerts for the symbols you are tracking and utilizing Google Translate to decipher foreign language information, you can often gain a significant lead time to react to negative developments or capitalize on positive trends before the majority of retail investors take notice. Many institutional investors already employ these strategies, but not all analysts within these organizations possess exceptional acumen. As a retail investor, there is still ample opportunity to gain a competitive edge by diligently conducting research and staying informed.